Identifying timely topics and trends in the sub-$200 million market.

Research Type: Emerging Timeliness: Current Date: July 28, 2023

MedX Health Corp. MDX $0.065

TSXV Exchange | OTC:MDXHF | Market Cap $12M

Description and Introduction:

Research Type: Emerging Timeliness: Current Date: July 28, 2023

MedX Health Corp. MDX $0.065

TSXV Exchange | OTC:MDXHF | Market Cap $12M

Description and Introduction:

- Skin cancer, including melanoma, is the most prevalent form of all cancers and its instances are actually increasing.

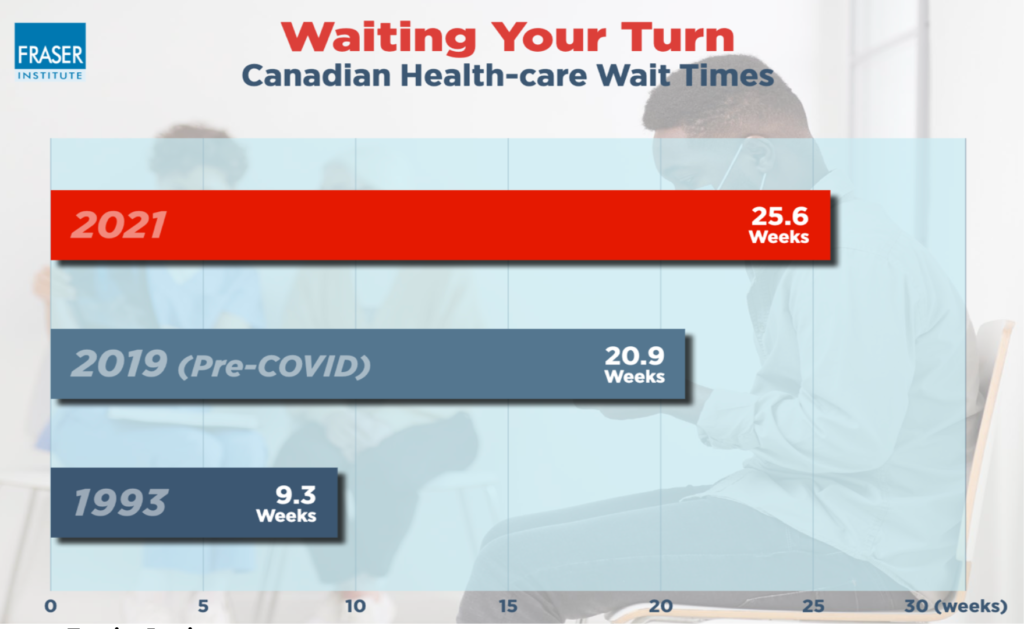

- The current standard of care for the diagnosis of skin cancer is very inefficient with significant wait times to see a dermatologist. Such delays could result in very bad outcomes for patients with acute situations.

- Elimination or reduction of the delays in the current diagnosis process can dramatically benefit patients.

- A patient in Canada who, either voluntarily or at his general practitioner’s (GP’s) urging, opts to have a technician at a PharmaChoice pharmacy scan a suspect area of skin with MedX’s equipment pays $100 out of pocket to the pharmacy for that service. In rough terms, approximately $20 of that fee is remitted to MedX.

- Under Canadian health care rules, the patient does not pay the dermatologist anything out of pocket to read and analyze the five high-definition images sent to him. The dermatologist is compensated by the Government Health-Care Plans work in assessing the scans.

- Pharmacies which have opted to participate in the PharmaChoice-MedX program have averaged about three users per non-weekend day since the program began a month ago. Assuming this usage level holds, and assuming 23 non-weekend days per month, a representative individual pharmacy could realize about $5,000 of monthly net cash flow from using a MedX SIAscopeTM unit to provide scanning services to its customers. This degree of cash flow suggests that an individual pharmacy’s payback period for purchasing the MedX equipment is only about 5-6 weeks.

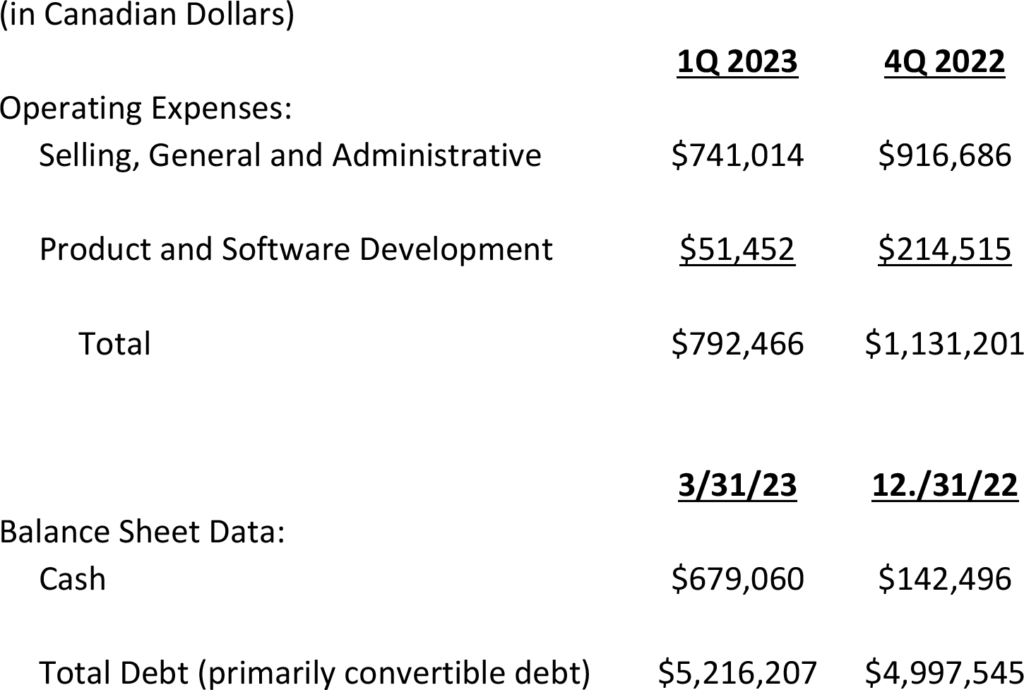

- Based on the same assumptions, MedX’s recurring cash flow, per adopting PharmaChoice pharmacy, should be around $1,300 per month.

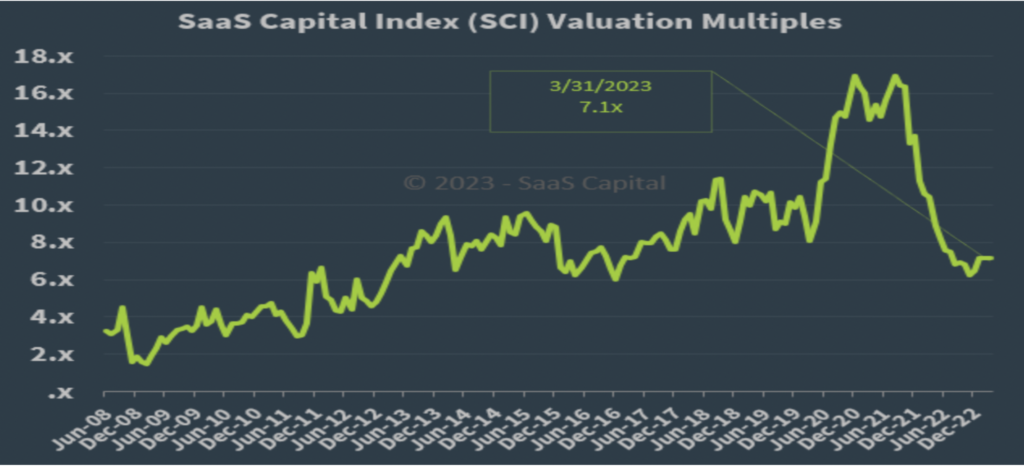

- If MedX’s management’s estimates regarding consistent additions to the rolls of PharmaChoice pharmacies which purchase MedX’s technology and offer the service to customers are correct, it is possible that the number of such adopting pharmacies could reach around 250 by year-end 2023 and perhaps 500 by sometime in 2024. That would imply that MedX’s relationship with PharmaChoice pharmacies could potentially generate about $350,000 in MedX monthly recurring cash flow (around a $4 million annualized pace) by late 2023 and about $700,000 in such monthly cash flow (about an $8 million annualized pace) sometime in 2024.

Tormont50 is a venue for highlighting timely ideas and trends in individual stocks and the stock market. Tormont50 is not an advisory service, and does not offer buy, sell, or any other rating on the securities we discuss. The companies we discuss for commentary are derived from an accumulation of publicly available data and information. We encourage all to submit stocks or topics for discussion. Our mandate is to create an exclusive, “concierge” community of growth companies within the Tormont50 universe. All members pay a monthly membership fee to be part of the Tormont50 community.

This message is intended only for the personal and confidential use of the designated recipient(s) members of the Tormont50. If you are not the intended recipient of this message you are hereby notified that any review, dissemination, distribution or copying of this message is strictly prohibited. This communication is for information purposes only and should not be regarded as an offer to sell or as a solicitation. This material is based upon information which we consider reliable, but we do not represent that such information is accurate or complete, and it should not be relied upon as such. This information is current and is subject to change. Past performance is not an indicator of future results and the value of the holdings and the income derived from them can go down as well as up.