200 milyon doların altındaki pazardaki konuların ve trendlerin zamanında belirlenmesi.

Research Type: Emerging | Timeliness: Current | Date: March 05, 2024

MedX Health Corp.

TSXV: MDX | OTC: MDXHF | Market Cap $10.5M | $0.04 (CAD)

Research Type: Emerging | Timeliness: Current | Date: March 05, 2024

MedX Health Corp.

TSXV: MDX | OTC: MDXHF | Market Cap $10.5M | $0.04 (CAD)

Recap: Founded in 1999, MedX Health Corp. (MedX) is a pioneer in the field of teledermatology via its SIAscope™ Class 2 medical scanning device, which, when used in conjunction with an HD camera, scans suspicious (potentially cancerous) moles and lesions to accurately generate high-quality images that can be reviewed for treatment options. These images are then uploaded to MedX’s proprietary DermSecure™ telemedicine platform to be securely transmitted to dermatologists for assessment.

Today’s report will talk more about the opportunity ahead, rather than the basics behind the business, as we have previously covered those topics in prior Tormont50 reports. For new investors to the story, we would suggest visiting the company’s website for a full overview of the business. www.medxhealth.com

Some key starting points are relevant to today’s discussion:

- The company has a technology moat built over more than two decades, with nearly $15 million in development costs and defensible patent protection backing a robust teledermatology platform;

- A proven track record of effective use, most notably in Norway via a Boots pharmacies deployment and regulatory approval from Health Canada, the FDA in the United States, the CE in Europe, and agencies in Great Britain, Australia and Brazil;

- Target markets that are chronically underserved, growing, and massive, measured in billions of dollars of annual care costs.

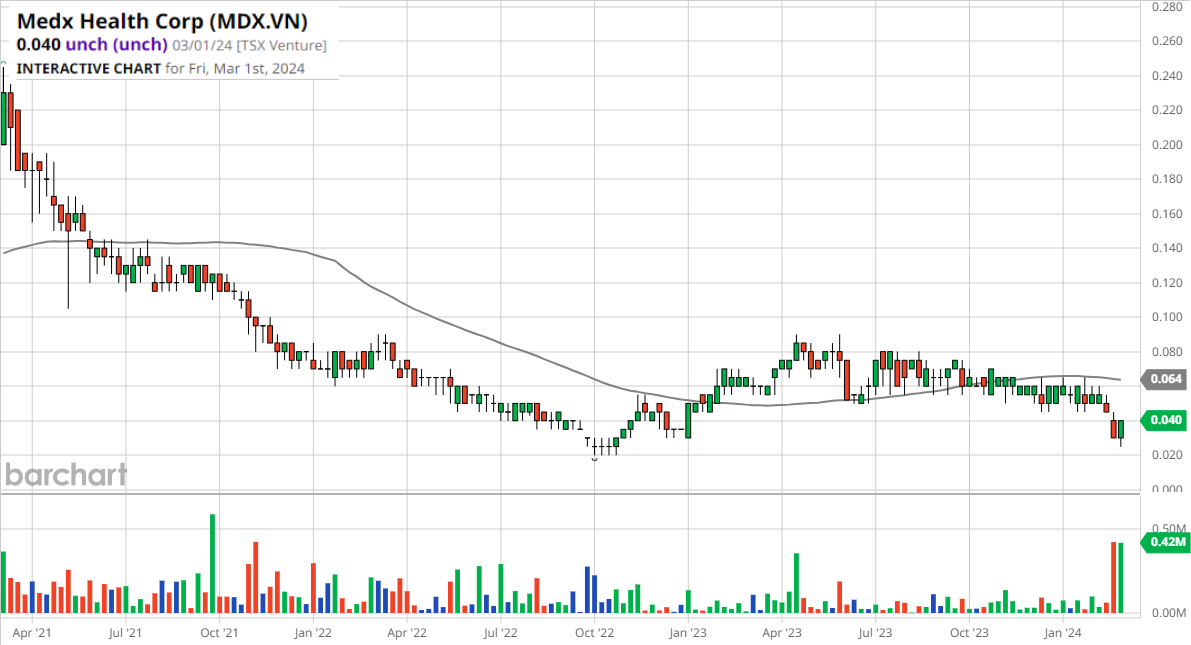

Why Now? One of the primary goals of the Tormont50 is to highlight catalysts in our member companies that could have a meaningful impact on future valuation, but are not yet reflected in the stock price. That concept is a bit of an understatement in terms of the MedX chart, which just recently revisited 52-week lows and has been trapped in that kind of post-downtrend malaise that is an all-too- familiar pattern in the world of nano-cap stocks. But it is exactly this disinterest that is setting up such a compelling entry point. The “Why Now?” moment for MedX came in its February 28, 2024 Health Partners press release, which signaled a fundamental change in the business model and outlook for the future.

Why Now? One of the primary goals of the Tormont50 is to highlight catalysts in our member companies that could have a meaningful impact on future valuation, but are not yet reflected in the stock price. That concept is a bit of an understatement in terms of the MedX chart, which just recently revisited 52-week lows and has been trapped in that kind of post-downtrend malaise that is an all-too- familiar pattern in the world of nano-cap stocks. But it is exactly this disinterest that is setting up such a compelling entry point. The “Why Now?” moment for MedX came in its February 28, 2024 Health Partners press release, which signaled a fundamental change in the business model and outlook for the future.

The Pre-Tipping Point Moment: Great technology does not always equate to immediate success in the marketplace, a situation MedX has experienced since entering its commercialization phase.

That concept underscores the importance of the February 28th press release, which had three significant catalysts that are new to the company’s story:

- A major partnership, as Health Partners is the UK’s largest non-hospital private healthcare services provider, with over two million patients across 550+ corporate, insurance and government clients;

- A New Revenue Model, with revenue shifting from primarily a pharmacy-style, per-device use model, to recurring revenue streams under three-year contracts for platform access;

- A New Market Focus, specifically targeting the Occupational Health market, which includes higher-risk individuals such as postal and construction workers who spend significant time outdoors.

Individually, each of these catalysts has the potential to add meaningful growth to the company’s revenue line, but taken together, they represent a potential company-maker, particularly in terms of replicating this strategy across new markets.

The Numbers: Here is the starting point – revenue figures that (under the old model) failed to show year-over-year acceleration.

The company hasn’t yet provided full details on pricing, but from what we do know thus far, the Health Partners relationship has the potential to exponentially accelerate revenue in a way that could elevate MedX into the top tier of growth metrics in the med-tech space.

That might sound like a bold statement, but

consider the following: Health Partners has ~300+ onsite and mobile units across its UK/Ireland footprint serviced by nearly 1,000 clinicians and employees, with more than 2.2 million individuals under its service umbrella. Just as importantly, the company ranks as the UK’s leading provider of workplace health services, aligning it squarely in the center of MedX’s new strategic focus (occupational health).

This is an important new distinction in the MedX model. At-risk individuals in high-exposure occupations need more frequent screening for skin cancer, creating a growing pool of perpetual end users of the MedX services via relationships with occupational health organizations. This new focus has global implications in terms of available markets.

All Boxes Checked: The economic and social impact of early diagnosis of melanoma is enormous, at a cost of just $2,500 per patient (and three days off work) for stage one vs $80,000 in annual costs (55 days off work) and a 23% 5-year survival rate for stage four. MedX is approaching this space with a proven solution in need of scale, so the Health Partners relationship offers a large step in that direction. The low-hanging fruit in this equation involves markets with limited dermatological coverage (Canada has just one dermatologist for every 69,000 people) and/or populations dispersed over wide geographic areas. Canada, the UK, Australia & the USA represent ideal markets under these scenarios.

An example of the growing need – the UK reached a record high number of skin cancer cases in 2023, with officials predicting that melanoma cases could soar by 50% over the next 20 years. For a quick read on this new market for MedX, we suggest a July 7, 2023, piece from the Health Editor of The Guardian.

An example of the growing need – the UK reached a record high number of skin cancer cases in 2023, with officials predicting that melanoma cases could soar by 50% over the next 20 years. For a quick read on this new market for MedX, we suggest a July 7, 2023, piece from the Health Editor of The Guardian.

2024 Should Be a Turning Point Year for MedX: It will take a quarter or two to get traction and trends on the numbers, but back of the envelope estimates all point to a potential hockey stick scenario for revenue in 2024.

Just the device channel fill alone into a portion of Health Partner’s ~300+ locations will give MedX a solid recurring revenue base. At $10,000 or less per unit, device revenue will be modest, but it is the annual (per device) DermSecure Platform Access fee that will provide the rocket fuel. Management hasn’t provided that pricing yet (and may not, for competitive reasons), but the access fee will be many times larger than the device cost and will allow unlimited scans per unit. A typical scanner has a throughput of 30 patients a day times 250 operating days in a year, equaling 7,500 patients a year per unit.

The two wildcards in the UK equation are how many devices (and DermSecure contracts) will Health Partners need to adequately service its more than two million patients and how fast will the program roll out? The good news for investors is that these questions will be answered through the end of the year and the impact will be rapid, with the potential for the first revenue bump as early as Q2/2024. Depending on the pace of the roll-out and other potential contracts, the company has, for the first time in years, a more viable path toward becoming cash flow positive and profitable on a go-forward basis.

Tormont50 MedX Checklist: This is clearly a developing story that may have collected more skeptics than fans over the years, but the current status of the MedX business plan checks many of the boxes that (in our experience) can lead to significant long-term growth. To name a few:

- The R&D is mainly complete, setting the stage for the positive impact that comes from scaling;

- The target markets are underserved and growing;

- Revenue is shifting to a recurring SaaS model, increasing the predictability and quality of financial results;

- Signing a major partner often opens new doors in new markets;

- MedX is working to replicate this new model in additional geographies with even larger potential than the UK.

From a technical perspective, none of these promising changes are baked into the price, as the stock remains in “show-me” mode within the confines of its long, post-downtrend range. Price performance at various stages over the last 52 weeks illustrates how stubborn this range has been. We don’t typically get the chance to write up stocks this close to a turning point (or potential bottom), but MDX should be of particular interest to deep-value, turnaround, and special situation fans.

The transition into a growth stock will have to play out in future quarters, but the imminent start of SaaS-driven revenue should earn MedX a place on microcap watch-lists. Simply put — scalable platform technology and recurring revenue are a potent combination. We expect that management will lift the cover quite a bit on this new business plan as it is implemented, but in the meantime, we suggest that Tormont50 members take a closer look at the much-improved MedX SaaS transition while it is still in its early stages.

Mark Forney

Tormont50 Araştırması

03/05/2024

Tormont50, bireysel hisse senetleri ve borsadaki güncel fikir ve eğilimlerin vurgulandığı bir mekandır. Tormont50 bir danışmanlık hizmeti değildir ve tartıştığımız menkul kıymetler üzerinde alım, satım veya başka herhangi bir derecelendirme sunmaz. Yorum yapmak için tartıştığımız şirketler, kamuya açık veri ve bilgilerin birikiminden türetilmiştir. Herkesi tartışma için hisse senedi veya konu sunmaya teşvik ediyoruz. Görevimiz, Tormont50 evreninde büyüme şirketlerinden oluşan özel bir "konsiyerj" topluluğu yaratmaktır. Tüm üyeler Tormont50 topluluğunun bir parçası olmak için aylık üyelik ücreti öderler.

Bu mesaj yalnızca Tormont50'nin belirlenmiş alıcı(lar)ı üyelerinin kişisel ve gizli kullanımı için tasarlanmıştır. Bu mesajın hedeflenen alıcısı değilseniz, bu mesajın herhangi bir şekilde incelenmesinin, dağıtılmasının, dağıtılmasının veya kopyalanmasının kesinlikle yasak olduğu konusunda sizi bilgilendiririz. Bu iletişim yalnızca bilgilendirme amaçlıdır ve bir satış teklifi veya talep olarak değerlendirilmemelidir. Bu materyal güvenilir olduğunu düşündüğümüz bilgilere dayanmaktadır, ancak bu bilgilerin doğru veya eksiksiz olduğunu beyan etmiyoruz ve bu bilgilere bu şekilde güvenilmemelidir. Bu bilgiler günceldir ve değişebilir. Geçmiş performans gelecekteki sonuçların bir göstergesi değildir ve varlıkların değeri ve onlardan elde edilen gelirler artabileceği gibi düşebilir.